Richard Grossman, professor of economics, recently co-authored an article titled “Before the Cult of Equity: the British Stock Market, 1829-1929” in European Review of Economic History, published on March 24, 2021. According to the paper's abstract, the co-authors "analyze the development and performance of the British equity market during the era when it reigned supreme as the largest in the world. By using an extensive monthly dataset of thousands of companies, we identify the major peaks and troughs in the market and find a relationship with the timing of economic cycles. We also show that the equity risk premium was…

Wesleyan in the News 1. Washington Post: "Biden Makes End Run Around Trump as the President Dominates the National Stage" Erika Franklin Fowler, associate professor of government and co-director of the Wesleyan Media Project, comments on Biden's unusual strategy during an unprecedented time for the 2020 presidential campaign. “There is not a ready off-the-shelf playbook for how you campaign in this environment if you are a nonincumbent, so that’s part of what you’re seeing,” she said. “We’re all being thrown into this new environment, where campaigns are going to need to reinvent, to some extent, how they go about things,…

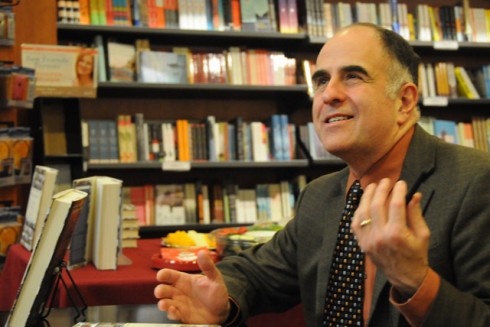

Richard Grossman, professor and chair of economics, is an expert in economic history as well as current policy issues in macroeconomics, banking, and finance. In this Q&A, we asked him about the economic fallout from the coronavirus pandemic, and how the government is responding in efforts to mitigate the damage. Q: We’ve all seen the headlines about a coronavirus-induced recession. What is the current state of the economy, and what do you predict we’ll see over the coming months? A: Prior to the virus outbreak, the American economy was doing well by conventional standards. The unemployment rate was 3.5% in…

In this recurring feature in The Wesleyan Connection, we highlight some of the latest news stories about Wesleyan and our alumni. Wesleyan in the News 1. CT Post: "Former Wesleyan Provost is First Woman President at Hobart and William Smith Colleges" Joyce Jacobsen, formerly Wesleyan's provost and senior vice president for academic affairs and the Andrews Professor of Economics, was inaugurated Oct. 18 as the first woman president of Hobart and William Smith Colleges. At the ceremony, the chairman of the HWS Board of Trustees said: “Dr. Jacobsen enters the presidency of Hobart and William Smith at a time of…

On Oct. 16, Richard Grossman, chair and professor of economics, discussed the latest unemployment numbers and current state of the economy with Todd Feinburg at WTIC in Hartford. This month, the national unemployment rate has fallen to a new low—3.5%. "Historically, and certainly for the last 10 years, the number peaked at 10% after the financial crisis, and it's been working its way down ever since," Grossman said. "That doesn't mean all is wonderful if you're in the labor force. There's a lot of other things going on ... people working part-time who would like to be working full-time ...…

In this recurring feature in The Wesleyan Connection, we highlight some of the latest news stories about Wesleyan and our alumni. Wesleyan in the News The Hill: "Analysis: 2020 Digital Spending Vastly Outpaces TV Ads" The Hill reports on a new analysis by the Wesleyan Media Project, which finds that 2020 presidential hopefuls have spent nearly six times more money on Facebook and Google advertising than on TV ads. President Donald Trump and the Republican National Committee lead the way in digital advertising, having spent nearly $16 million so far. All told, Facebook and Google have raked in over $60 million…

Richard Grossman, professor of economics, authored a blog post on the Vox CEPR website with Gareth Campbell and John Turner (Queen’s University Belfast) titled, “New monthly indices of the British stock market, 1829-1929." Although long-run stock market data are an important indicator, obtaining them is challenging. This column constructs new long-run broad-based indices of equities traded on British securities markets for the period 1829-1929 and combines them with a more recent index to examine the timing of British business cycles and compare returns on home and foreign UK investment. One finding is that the capital gains index of blue-chip companies…

Wesleyan faculty frequently publish articles based on their scholarship in The Conversation US, a nonprofit news organization with the tagline, “Academic rigor, journalistic flair.” In a new article, Professor and Chair of Economics Richard Grossman analyzes the latest jobs report. May jobs report suggests a slowing economy – and possibly an imminent interest rate cut The latest jobs data suggests an interest rate cut may be imminent. The Labor Department reported on June 7 that U.S. nonfarm payroll employment increased by 75,000 in May, while the unemployment rate remained unchanged at 3.6%. This level of job creation was well below economists’ forecasts…

In this recurring feature in The Wesleyan Connection, we highlight some of the latest news stories about Wesleyan and our alumni. Recent Wesleyan News The Washington Post: "Major Trump Administration Climate Report Says Damage is 'Intensifying Across the Country'" Gary Yohe, the Huffington Foundation Professor of Economics and Environmental Studies, was widely quoted in the media about the fourth National Climate Assessment, the first to be released under the Trump Administration. "The impacts we’ve seen the last 15 years have continued to get stronger, and that will only continue,” Yohe, who served on the National Academy of Sciences panel that…

Professor of Economics Richard Grossman was asked by Wales Online about his expectations for the economic impact of Brexit over the next few years. He said: "Leaving the European Union will be a drag on the British economy in the medium term. Even before Brexit takes effect, however, the economy will be hurt by two factors: expectations and uncertainty. “The expectation that the UK will no longer have free access to the European market may lead exporters to reorient production toward domestic consumption or export to non-EU regions well before Brexit comes into force. UK-based financial firms may shift operations to EU…

On June 23, Professor of Economics Richard Grossman presented a paper at an economic history symposium jointly sponsored by the Bank of England and the the Centre for Economic Policy Research. Titled, "Beresford's Revenge: British equity holdings in Latin America, 1869-1929," the paper looks at stock market returns of Latin American firms traded on the London Stock Exchange. The program for the conference can be seen here.

Professor of Economics Richard Grossman tells his students that getting closer to the truth is what economic research is all about. That's why he was so dismayed when "my devotion to, and belief in, the truth was battered by the presidential election," he writes in an op-ed on The Hill. He writes: It turns out that polling data and analysis contained very little truth. The news were no better. The mainstream media got many things wrong. And there was no shortage of fake news. Although peddled as the real thing, it really wasn’t even trying to provide truth, only to shape opinion.…