Wesleyan Investment Group Takes 1st Place in Adirondack Cup

The student-run Wesleyan Investment Group (WIG) is celebrating a first-place victory in a six-month-long collegiate investment contest that concluded April 9.

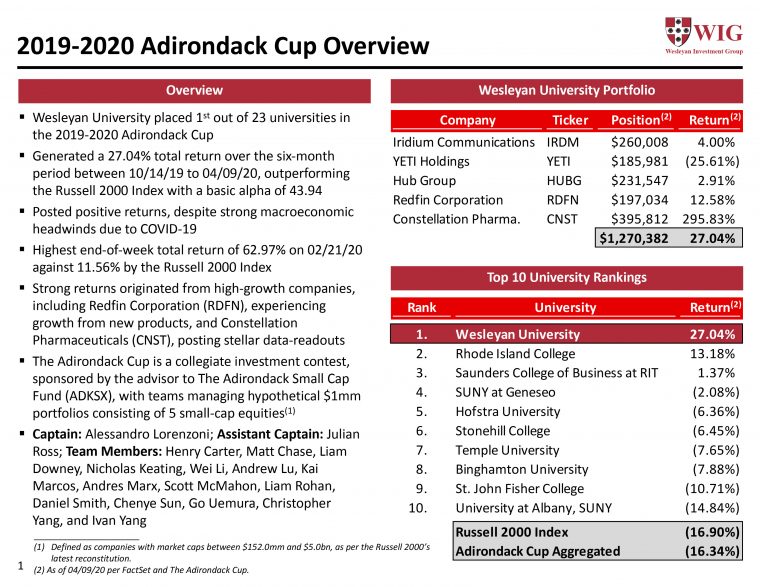

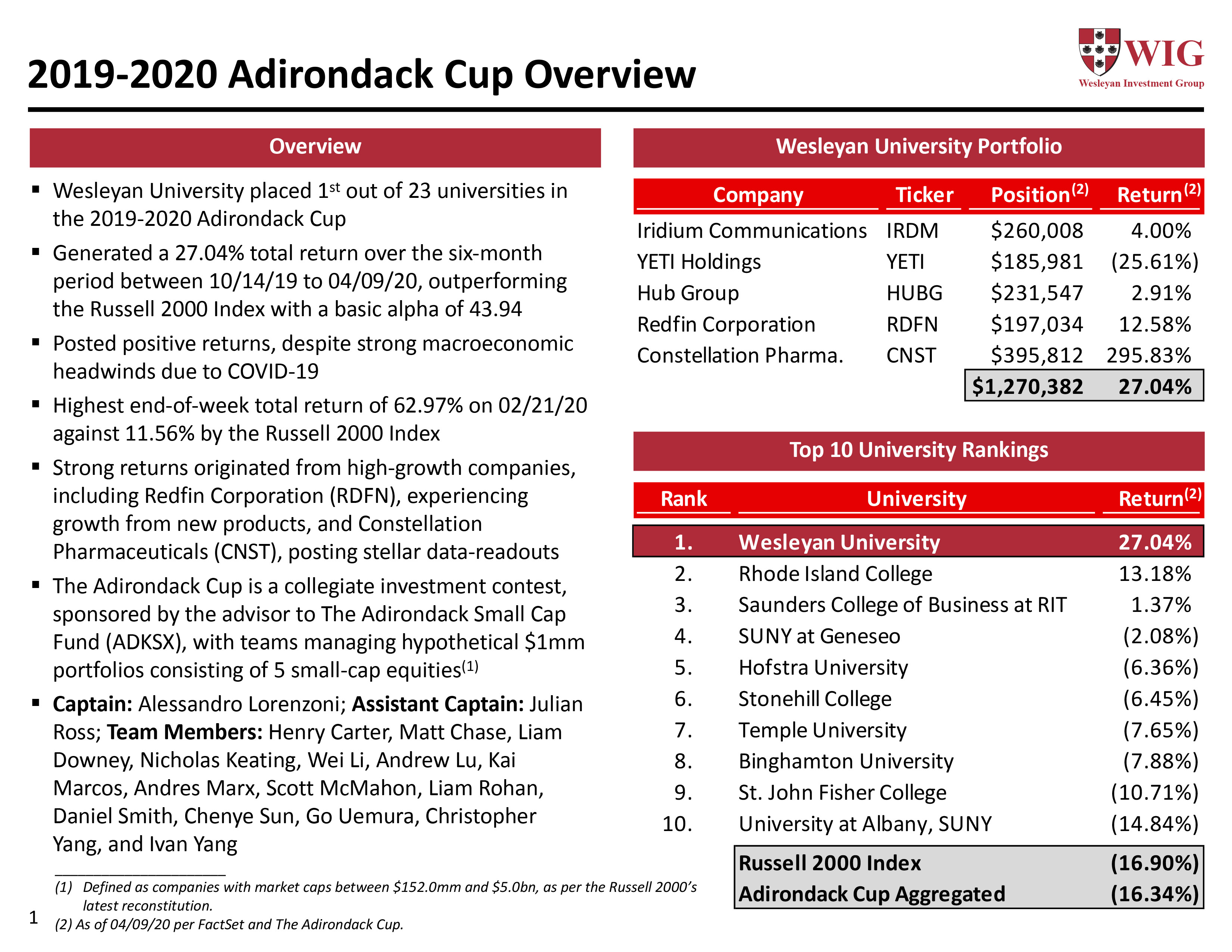

Despite the COVID-19 epidemic’s detrimental impact to the stock market, WIG managed to garner a 27.04% return in the 2019–20 Adirondack Cup, a stock-picking contest sponsored by the advisor to The Adirondack Small Cap Fund (ADKSX). Wesleyan competed against 22 other institutions in New England and New York.

Each student team managed a hypothetical $1 million portfolio consisting of five small cap equities. Team members studied the performance of more than 100 businesses and predicted which ones would perform the best between October 2019 and April 2020. To encourage a long-term focus, teams are only allowed to change their portfolio once during the competition.

“Wesleyan students have long enjoyed the challenge of the Adirondack Cup,” explained Abigail Hornstein, associate professor of economics. “This competition thus greatly rewards teams that front-load their research and that have a clear understanding of how small firms may respond to the broader economy.”

Wesleyan has participated in the competition since 2011, and finished second in 2016–17. This year, the team placed first throughout the entire six months of competition. WIG’s highest end-of-week total return was 62.97% on Feb. 21 against 11.56% by the Russell 2000 Index, which measures the value of 2000 small cap businesses worth between $300 million and $2 billion.

Wesleyan’s team was captained by Alessandro Lorenzoni ’20 and Julian Ross ’21. Team members included Henry Carter ’22, Matt Chase ’21, Liam Downey ’22, Nicholas Keating ’22, Wei Li ’21, Andrew Lu ’23, Kai Marcos ’22, Andres Marx ’22, Scott McMahon ’22, Liam Rohan ’22, Daniel Smith ’21, Chenye Sun ’22, Go Uemura ’23, Christopher Yang ’23, and Ivan Yang ’21.

Lorenzoni ’20, an economics and computer science double major and data analysis minor, believes the team’s selection of companies with a wide range of growth levels helped to round out the portfolio and resist market turmoil stemming from COVID-19.

“We were well-organized during the search process for potential investments, ensuring that we covered a wide range of industries. On top of that, everyone did an exemplary job of bringing forward companies with near-term growth catalysts, especially given the short-term nature of this competition,” Lorenzoni explained. “Of course, there is also the ever-present element of luck that helped push returns in our favor.”

As winners of the Adirondack Cup, the Wesleyan Investment Team will be invited to a luncheon with an ADKSX portfolio manager and have a chance to present their investment thesis.

“This really was a team effort, and I can’t stress how vital a role everyone played in winning this competition,” Lorenzoni said.