David Kuenzel, associate professor of economics, is the co-author of a new paper published in the European Economic Review titled "Preferential Trade Agreements and MFN Tariffs: Global Evidence." In the paper, Kuenzel and his co-author, Rishi Sharma from Colgate University, study theoretically and empirically the effects of countries' import composition on multilateral liberalization using a global tariff database that covers the 2000–2011 period. Kuenzel and Sharma provide evidence that greater preferential trade agreement (PTA) import shares induce tariff cuts on non-member countries. The baseline estimates imply that a 10 percentage point increase in the share of imports from PTA partners…

In recognition of their career achievements, the following faculty members are being appointed to endowed professorships, effective July 1, 2021: Erik Grimmer-Solem, professor of history, is receiving the Ezra and Cecile Zilkha Professorship in the College of Social Studies, established in 2008. Abigail Hornstein, associate professor of economics, is receiving the Woodhouse/Sysco Professorship of Economics, established in 2002. Edward Moran, professor of astronomy, is receiving the John Monroe Van Vleck Professorship of Astronomy, established in 1982. Suzanne OConnell, professor of earth and environmental sciences, is receiving the Harold T. Stearns Professorship of Earth Sciences, established in 1984. Francis Starr, professor…

Can wolves help prevent deer-vehicle collisions? According to a new study by Assistant Professor of Economics Jennifer Raynor, areas with wolf populations are seeing a 24 percent decline of car vs. deer accidents due to the canines creating a "landscape of fear" in ways human deer hunters cannot. Her study, titled “Wolves make roadways safer, generating large economic returns to predator conservation” was published by the Proceedings of the National Academy of Sciences (PNAS) on June 1. Raynor and her co-PIs investigated the potentially positive presence of wolves in relationship to roadways by examining 22 years of data from Wisconsin. The…

Richard Grossman, professor of economics, recently co-authored an article titled “Before the Cult of Equity: the British Stock Market, 1829-1929” in European Review of Economic History, published on March 24, 2021. According to the paper's abstract, the co-authors "analyze the development and performance of the British equity market during the era when it reigned supreme as the largest in the world. By using an extensive monthly dataset of thousands of companies, we identify the major peaks and troughs in the market and find a relationship with the timing of economic cycles. We also show that the equity risk premium was…

Wesleyan's Board of Trustees recently announced the promotions of nine faculty members, effective July 1, 2020. Five faculty were conferred tenure with promotion. They join six other faculty members who were awarded tenure earlier this spring. Joslyn Barnhart Trager, associate professor of government Anthony Keats, associate professor of economics Andrew Quintman, associate professor of religion Michael Slowik '03, associate professor of film studies Takeshi Watanabe, associate professor of East Asian studies In addition, four faculty members are being promoted. They join one other faculty member who was promoted earlier this spring. Erika Franklin Fowler, professor of government Barbara Juhasz, professor…

David Kuenzel, assistant professor of economics, is the author of a paper titled "WTO Tariff Commitments and Temporary Protection: Complements or Substitutes?" The paper was published in the January issue of the European Economic Review. In the paper, Kuenzel investigates the link between traditional tariff instruments and temporary protection measures (antidumping, safeguard, and countervailing duties). There is a long-held notion in the trade policy community that most-favored-nation (MFN) tariffs and temporary protection measures are substitutes. Despite this prediction, there is only mixed empirical evidence for a link between MFN tariff reductions and the usage pattern of antidumping, safeguard, and countervailing…

Jennifer Raynor, assistant professor of economics, is the co-author of a study titled "Can native species compete with valuable exotics? Valuing ecological changes in the Lake Michigan recreational fishery," published in the Journal of Great Lakes Research, 2020. The Chinook salmon population in Lake Michigan is declining precipitously due to ecological changes, and the impact on recreational fishing value is unknown. In this study, Raynor estimates a conditional model to characterize how Wisconsin resident anglers react to changes in species-specific availability and catch rates. "Using these results, we calculate the non-market value of access to the fishery that reflects current,…

Wesleyan in the News 1. Washington Post: "Biden Makes End Run Around Trump as the President Dominates the National Stage" Erika Franklin Fowler, associate professor of government and co-director of the Wesleyan Media Project, comments on Biden's unusual strategy during an unprecedented time for the 2020 presidential campaign. “There is not a ready off-the-shelf playbook for how you campaign in this environment if you are a nonincumbent, so that’s part of what you’re seeing,” she said. “We’re all being thrown into this new environment, where campaigns are going to need to reinvent, to some extent, how they go about things,…

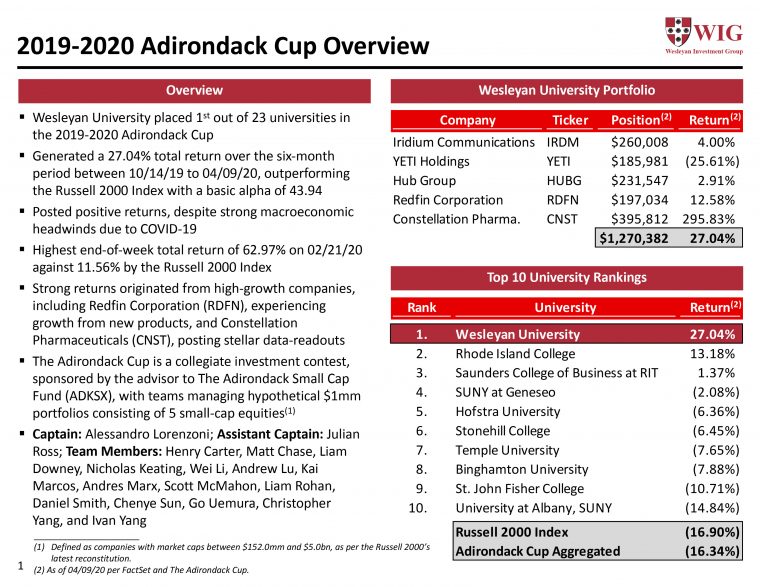

The student-run Wesleyan Investment Group (WIG) is celebrating a first-place victory in a six-month-long collegiate investment contest that concluded April 9. Despite the COVID-19 epidemic's detrimental impact to the stock market, WIG managed to garner a 27.04% return in the 2019–20 Adirondack Cup, a stock-picking contest sponsored by the advisor to The Adirondack Small Cap Fund (ADKSX). Wesleyan competed against 22 other institutions in New England and New York. Each student team managed a hypothetical $1 million portfolio consisting of five small cap equities. Team members studied the performance of more than 100 businesses and predicted which ones would perform…

Wesleyan in the News 1. CNN: "How Coronavirus Has Reshaped Democratic Plans for 2020" This article on how Democrats are politicizing the government's response to the coronavirus crisis features research by the Wesleyan Media Project, which found that this past month has seen a huge drop in campaign advertising overall. "The messaging and the attacks that we've seen on [coronavirus] do feel louder ... in part because there are fewer messages overall," said Erika Franklin Fowler, associate professor of government, co-director of the Wesleyan Media Project. She notes that health care was emerging as a top issue in 2020 advertising…

Richard Grossman, professor and chair of economics, is an expert in economic history as well as current policy issues in macroeconomics, banking, and finance. In this Q&A, we asked him about the economic fallout from the coronavirus pandemic, and how the government is responding in efforts to mitigate the damage. Q: We’ve all seen the headlines about a coronavirus-induced recession. What is the current state of the economy, and what do you predict we’ll see over the coming months? A: Prior to the virus outbreak, the American economy was doing well by conventional standards. The unemployment rate was 3.5% in…

Gil Skillman, professor of economics, is the author of “Moseley’s ‘Macro-Monetary’ Reading of Marx’s Capital: Rejoinder and Further Discussion,” published in the Review of Radical Political Economics on Dec. 17, 2019. According to the abstract: Moseley (2018) offers a partial reply to Skillman's review of his Money and Totality, addressing one comment at length while mentioning a second in passing and ignoring the third. In this rejoinder, Skillman responds to his replies and develops the three main arguments of his review in greater detail, with particular focus on the logical consistency of Moseley’s “algebraic summary” of his macro-monetary reading of…