Basil John Moore, professor emeritus of economics, passed away on March 8 at the age of 84. Moore, who received his BA from the University of Toronto and his PhD from Johns Hopkins University, came to Wesleyan in 1958. He retired in 2003 after 45 years of scholarship that took him to Cambridge, Stanford, Morocco, Vancouver, Malaysia, the Philippines, Sri Lanka, Singapore, Korea, India, and Stellenbosch, South Africa. (more…)

When President Michael Roth speaks about the purpose of college, he frequently boils it down to three key things: students should find what they love to do, get better at it, and learn to share what they love with others. This semester, Wesleyan is adding to its curriculum to help students develop this third critical skill. Wesleyan recently received a 3-1/2 year grant for over $600,000 to pilot on campus the Calderwood Seminars, which train students in translating complex arguments and professional jargon from their academic disciplines into writing that can be understood and appreciated by the general public. The seminars, developed by…

Melanie Khamis, assistant professor of economics and assistant professor of Latin American studies, has co-authored a new paper published in the December 2017 issue of Labour Economics. The paper, titled "Women make houses, women make homes," examines the effects of historical labor market institutions and policies on women’s labor market outcomes. To conduct the research, Khamis and her colleagues studied the “rubble women” of post–World War II Germany, who were subject to a 1946 Allied Control Council command that required women between the ages of 15 and 50 to register with a labor office and to participate in postwar cleanup and…

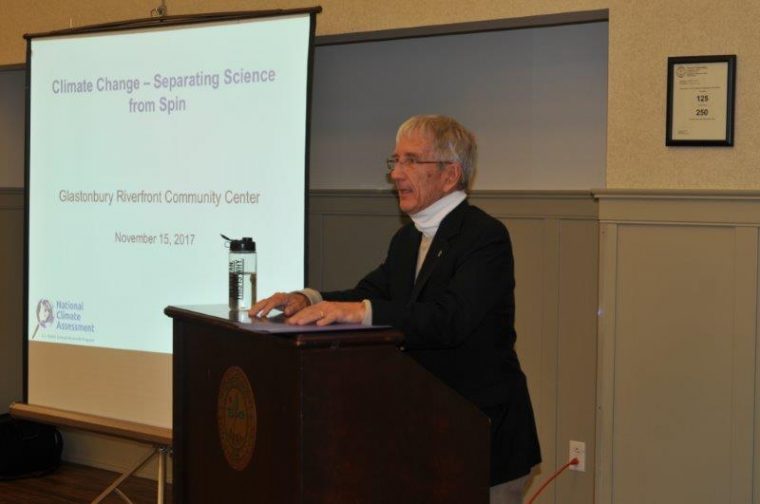

On Nov. 15, Gary Yohe, the Huffington Foundation Professor of Economics and Environmental Studies, delivered a talk on climate change at the Glastonbury (Conn.) Riverfront Community Center. It was sponsored by the Land Heritage Coalition of Glastonbury, Inc.— a non-profit corporation whose mission is to support farming, open space preservation, and water and wetlands protection—as its annual educational initiative. “As part of our mission, we feel it important to help folks in Connecticut understand the issue of climate change, what the local impacts are, and what we can do in this state,” explained David Ahlgren, LHC co-president. “There’s a lot…

Gary Yohe, the Huffington Foundation Professor of Economics and Environmental Studies, writes in The Conversation about the recently published Climate Science Special Report. While he, like many others, had feared that the Trump White House would reject the report, instead, he writes, "last week's release was like trick-or-treating on Halloween and coming to a house with a bowl of candy at the door but no one home." (more…)

Provost and Vice President for Academic Affairs Joyce Jacobsen spoke at an event on Sept. 29 at the Center for American Progress in Washington, D.C. The event was on the topic, The Economics of Misogyny. Jacobsen spoke on the topic of feminist economics in conversation with Judith Warner, senior fellow at the Center for American Progress. A video recording of the event can be seen here. Jacobsen also is the Andrews Professor of Economics.

Associate Professor of Economics Abigail Hornstein's article, "Words vs. actions: International variation in the propensity to fulfill investment pledges in China," was published in the journal China Economic Review in July 2017. Hornstein studied whether companies from certain countries were more likely than others to fulfill investment pledges. On average, she found that firms fulfilled about 59 percent of their pledges within two years. This number was lower for firms in countries with greater uncertainty avoidance, power distance, and egalitarianism; and higher for those in countries that are more traditional. She also found that popular attitudes toward China did not affect the likelihood…

In the near future, the Trump Administration must decide whether to approve or reject a new scientific report on climate change. Writing in The Conversation, Gary Yohe, the Huffington Foundation Professor of Economics and Environmental Studies, asserts, "If the Trump administration chooses to reject the pending national Climate Science Special Report, it would be more damaging than pulling the United States out of the Paris Climate Agreement. Full stop." Yohe backs up this bold claim by explaining why this report is so important and describing a crucial difference between the report and the Paris Climate Agreement. Namely, "the Paris accord focuses on…

Gary Yohe, the Huffington Foundation Professor of Economics and Environmental Studies, writes in HuffPost that the Trump Administration must acknowledge and factor in the effects of climate change when it tackles American infrastructure. (more…)

Ben Oppenheim ’02, a consulting scientist with Metabiota, a start-up focusing on epidemiological modeling and epidemic risk preparedness, was recently invited to participate in a workshop at the National Academy of Medicine. As a result, Oppenheim and his colleagues wrote an article published in Lancet Global Health titled "Financing of International Collective Action for Epidemic and Pandemic Preparedness," based on these meetings. Also writing for the Brookings Institution, Oppenheim further explored the challenges of responding to global outbreaks, offering a four-point plan to protect the global poor during pandemics, with co-author Gavin Yamey. "Post-Ebola and Zika, there's been increasing worry—and debate—about how to prepare…

Professor of Economics Richard Grossman was asked by Wales Online about his expectations for the economic impact of Brexit over the next few years. He said: "Leaving the European Union will be a drag on the British economy in the medium term. Even before Brexit takes effect, however, the economy will be hurt by two factors: expectations and uncertainty. “The expectation that the UK will no longer have free access to the European market may lead exporters to reorient production toward domestic consumption or export to non-EU regions well before Brexit comes into force. UK-based financial firms may shift operations to EU…

On June 23, Professor of Economics Richard Grossman presented a paper at an economic history symposium jointly sponsored by the Bank of England and the the Centre for Economic Policy Research. Titled, "Beresford's Revenge: British equity holdings in Latin America, 1869-1929," the paper looks at stock market returns of Latin American firms traded on the London Stock Exchange. The program for the conference can be seen here.