Associate Professor of Economics Abigail Hornstein, together with Minyuan Zhao of The Wharton School, University of Pennsylvania, has coauthored an article on corporate philanthropy published in the Aug. 1 issue of Strategic Management Journal. Corporate philanthropy has long been recognized as an important part of multinational strategy, but little is known about how it is allocated across different countries. Using data from a sample of more than 200 U.S.-based corporate foundations from 1993 to 2008, Hornstein and Zhao examined how foundation giving is associated with the funding firm’s need to navigate the local business environments. They found that foundations give more…

When President Michael Roth speaks about the purpose of college, he frequently boils it down to three key things: students should find what they love to do, get better at it, and learn to share what they love with others. This semester, Wesleyan is adding to its curriculum to help students develop this third critical skill. Wesleyan recently received a 3-1/2 year grant for over $600,000 to pilot on campus the Calderwood Seminars, which train students in translating complex arguments and professional jargon from their academic disciplines into writing that can be understood and appreciated by the general public. The seminars, developed by…

Associate Professor of Economics Abigail Hornstein's article, "Words vs. actions: International variation in the propensity to fulfill investment pledges in China," was published in the journal China Economic Review in July 2017. Hornstein studied whether companies from certain countries were more likely than others to fulfill investment pledges. On average, she found that firms fulfilled about 59 percent of their pledges within two years. This number was lower for firms in countries with greater uncertainty avoidance, power distance, and egalitarianism; and higher for those in countries that are more traditional. She also found that popular attitudes toward China did not affect the likelihood…

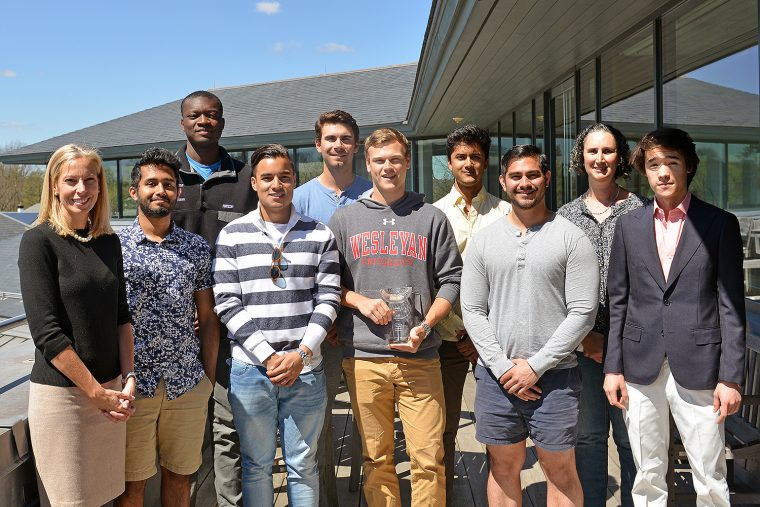

A team of Wesleyan students took second place with a 24.28 percent return in the 2017 Adirondack Cup, a stock picking contest for college students interested in the investment field. This is the sixth year that Wesleyan has fielded a team, and represented the best performance to date. The contest offers a unique setting for students to test their investment research skills using businesses not widely covered by analysts and the news media. Over 160 students from 22 colleges and universities participated in the contest this year, which focuses exclusively on "small cap" public companies, the expertise of the contest's…

Abigail Hornstein, associate professor of economics, presented two papers at the 2017 American Economic Association meeting held Jan. 6-8 in Chicago. In her working paper, "Words vs. Actions: International Variation in the Propensity to Honor Pledges," Hornstein used data on contracted and utilized foreign direct investment in China to show that firms fulfill an average of 59 percent of their pledges within two years. "The propensity to fulfill contracts is lower for firms from countries with greater uncertainty avoidance, power distance and egalitarianism; and is higher if the source country is more traditional," she explained. Prior literature has shown that…

Associate Professor of Economics Abigail Hornstein and James Hounsell '11 are the authors of a new paper published in The Journal of Economics and Business titled "Managerial investment in mutual funds: Determinants and performance implications." In the paper, Hornstein and Hounsell examine what determines managerial investments in mutual funds, and the impacts of these investments on fund performance. By using panel data they show that investment levels fluctuate within funds over time, contrary to the common assumption that cross-sectional data are representative. Managerial investments reflect personal portfolio considerations while also signaling incentive alignment with investors. The impact of managerial investment on performance…

Associate Professor of Economics Abigail Hornstein presented a paper at the 2015 American Financial Management Association Meeting, held in Orlando, Fla. Oct. 14–17. Hornstein's research paper, titled "Board Overlaps in Mutual Fund Families," is co-authored with Elif Sisli Ciamarra of Brandeis University. Hornstein also was a discussant on a paper titled "Mutual fund home bias and market uncertainty" by Nicole Choi of the University of Wyoming and Hilla Skiba of Colorado State University.

On Feb. 6, recent Wesleyan graduates returned to campus and shared their experiences in finance. The conference, titled "Finance — Theory and Applications: A Conversation with Alumni," covered mergers and acquisitions, value investing, trading and case study analysis. Attendees also had an opportunity to ask questions. Anand Gopalan ’09, James Hounsell ’11 and Eugene Wong ’09, all of whom have relevant experience in the field of finance, spoke at the event. Joyce Jacobsen, professor of economics, also gave remarks at the conference. The event was hosted by Abigail Hornstein, associate professor of economics, with support from the Allbritton Center for the Study of Public Life…

Abigail Hornstein, associate professor of economics, and her former thesis student, Zachary Nguyen '12 are the co-authors of a paper titled "Is More Less? Propensity to Diversify via M&A and Market" published in the International Review of Financial Analysis, June 2014, pp. 64-88. Mergers and acquisitions (M&A) could lead to a firm diversifying into new industries, and the impact of this may be related to the firm’s prior diversification. By using a panel of 1,030 M&A transactions from 2000-2010, Hornstein and Nguyen found that that previously diversified firms are more likely to pursue industrially diversifying M&A. "Both previous and contemporary diversification…

The Board of Trustees recently conferred tenure to four Wesleyan faculty. Their promotions take effect July 1. They are: Lisa Cohen, associate professor of English; Abigail Hornstein, associate professor of economics; Miri Nakamura, associate professor of Asian languages and literatures; and Anna Shusterman, associate professor of psychology. Other tenure announcements may be released after the Board's May meeting. "Please join us in congratulating them on their impressive records of accomplishment," said Wesleyan President Michael Roth. Brief descriptions of their areas of research and teaching are below: Lisa Cohen joined the English Department’s creative writing faculty in Fall 2007. Her courses are…

This article has moved to: https://newsletter.blogs.wesleyan.edu/2014/03/31/tenurespring20142/

Assistant Professor of Economics Abigail Hornstein recently has had two academic papers published. In September 2012, her paper, "Usage of an estimated coefficient as a dependent variable," co-authored with William Greene of New York University's Stern School of Business, was published in the journal Economics Letters. The paper demonstrated the efficiency gains of a particular set of empirical estimation techniques. It is available online here. In addition, Hornstein's solo-authored paper, titled, "Corporate capital budgeting and CEO turnover," was published in December 2012 in the Journal of Corporate Finance. In this paper, she demonstrated the considerable cross-sectional and inter-temporal variation in the quality of a firm's…